Have you ever had the feeling that every time your salary goes up a little, that money disappears every time you go shopping? As much as we are told that statistically salaries are rising, the purchasing power of the average American citizen has vanished. Grocery bills now have prices that make your head spin. Not only are we dealing with inflation that makes a dozen eggs or gas more expensive, but it’s also affecting the amount of taxes we pay.

However, there is some good news: the Internal Revenue Service has confirmed the new tax brackets for next year. For the 2026 tax year, tax brackets have been adjusted upward with the COLA, or cost-of-living adjustment, of 2.8%. Although this may seem like a small and insignificant number, this adjustment is designed to prevent a phenomenon known as bracket creep.

Understanding tax brackets

There is a rather counterproductive myth that many people believe: if you earn one more dollar and move up to the next tax bracket, the government will take your entire salary in that bracket. However, this is completely false. Instead, we should think of taxes as a series of buckets of water.

The first bucket is small, and is taxed at a very low rate of 10%. Once that bucket overflows to the brim, the extra money starts to fall into the second bucket at a slightly higher rate (12%), and so on.

What the IRS has done is make those first buckets of water—taxed at 10% and 12%—bigger. That means we can now earn more money and keep it in these buckets before we have to start filling the more expensive buckets. If the IRS hadn’t done this, we would have ended up paying more, even though we aren’t really richer due to today’s rampant inflation.

New 2026 guidelines

Here are the exact figures published by the IRS.

Single Filers

- Your first bracket is 10% and covers income from $0 to $12,400.

- Your second bracket is 12% and ranges from $12,401 to $50,400 (that’s the most common bracket for working people).

- The next jump is to 22%, covering income from $50,401 to $105,700.

- If you earn more, you enter the 24% bracket, which ranges from $105,701 to $201,775.

- For high incomes, the 32% bracket ranges from $201,776 to $256,225.

- The penultimate bracket of 35% covers income from $256,226 to $640,600.

- And finally, the maximum bracket of 37% only applies to income above $640,600.

Joint filers

Tax brackets for joint filers are twice as large. Being married actually pays off, or so it seems:

- The 10% bracket ranges from $0 to $24,800.

- The 12% bracket ranges from $24,801 to $100,800.

- The 22% bracket ranges from $100,801 to $211,100. …and so on.

And for couples with very high incomes, the maximum 37% bracket only starts at $768,701.

The One Big Beautiful Bill

All these changes are the direct result of the law signed by President Donald Trump on July 4, 2025.

Among other things, it turned out to be a legislative move to prevent taxes from automatically increasing. In 2017, tax cuts were approved that were set to expire in 2025. The OBBB law made these cuts permanent.

As a result, the law brought changes for service workers and the middle class. For example, this law establishes that tips are no longer subject to federal income tax. In addition, overtime pay also receives preferential tax treatment to encourage work.

Finally, a deduction was introduced for interest on car loans, as long as the vehicle was assembled in the United States.

How to take advantage of these changes

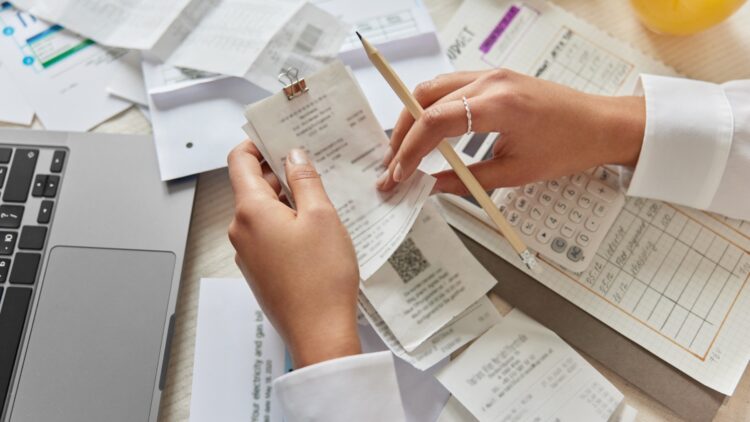

To ensure we don’t pay more taxes than we have to, we need to keep deductions in mind. For example, if you are self-employed, home office deductions are vital. In addition, charitable donations—which are commendable—can help you lower your tax bracket. This would be killing two birds with one stone: helping causes that are close to your heart and not paying extra taxes.

However, the IRS has announced that it will be auditing more aggressively to ensure that no one cheats. The golden rule for 2026 will be “if you don’t have the receipt, don’t claim the deduction.”